Health Insurance

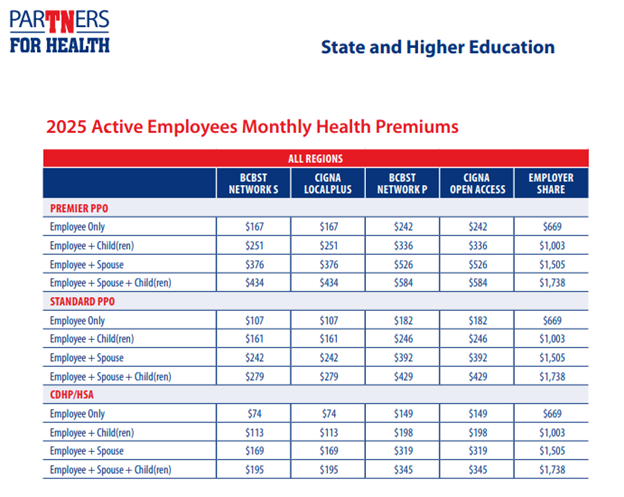

Standard PPO

- Lower premiums than the Premier PPO― but you’ll pay more out-of-pocket for your deductible, copays and coinsurance.

Premier PPO

- Higher premiums― but lower out-of-pocket costs for your deductible, copays and coinsurance.

CDHP/HSA

Lowest premiums―but you pay your deductible first before the plan pays anything for most services, and then you pay coinsurance, not copays.

- You get a health savings account (HSA) to help you save for your healthcare now and in the future, and it offers tax benefits. You can use it for qualified healthcare expenses, including your deductible and to save for retirement.

- The state will put money into your HSA at the beginning of the year or when new hire coverage begins: $500 for employee-only coverage or $1,000 for family coverage. This money applies to your maximum contribution. The state does not put money into your HSA if your coverage starts September 2 through December 31.

- Take the savings from your lower premium and put them in your HSA to cover your deductible! Your HSA balance carries over each year.

- Learn more about CDHP/HSA.

Helpful Videos:

BlueCross BlueShield Network S

- Search for a Provider Online (Be sure to select Blue Network S before searching)

- List of participating providers

- List of participating network hospitals

- Member Handbook

BlueCross BlueShield Network P

- Search for a Provider Online (Be sure to select Blue Network P before searching)

- List of participating providers

- List of participating network hospitals

- Member Handbook

Cigna LocalPlus

- Search for a Provider Online

- List of participating providers vol. 1

- List of participating providers vol. 2

- List of participating providers vol. 3

- List of participating network hospitals

- Member Handbook

Cigna Open Access Plus

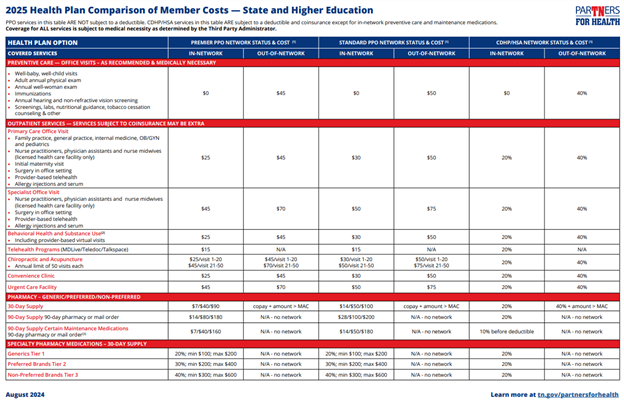

All of our health plans include full prescription drug benefits.

The health plan you choose determines your out-of-pocket prescription costs, which include your copay, coinsurance, deductible and out-of-pocket maximum.

The drug tier – if you choose a generic, preferred brand, non-preferred brand or specialty drug (new - two different cost tiers in the preferred provider organization plans);

The day supply you receive – 30-day (or <30) supply or 90-day (>31) supply; and

Where you fill your prescription – at a retail, Retail-90 or mail order pharmacy.

- CVS/caremark Handbook

- Find a pharmacy:

- You can find a 30-day or 90-day network pharmacy through the Caremark website at info.caremark.com/stateoftn.

- You can also call Caremark customer service at 877.522.8679 to find a network pharmacy near you.

- Click here for FAQs.

- Click here for a 2025 benefit comparison, including pharmacy, for state and higher education.

- Click here for the CVS Caremark preferred drug list. (This list is updated each January, April, July and October.)

- Click here for a list of medications that require prior authorization for medical necessity.

- Click here for a list of medications with utilization management requirements such as prior authorization, step therapy or quantity limits.

BlueCross BlueShield of Tennessee

800.558.6213

Monday - Friday, 7 a.m. - 5 p.m. CT

bcbst.com/members/tn_state/

Cigna

Cigna

800.997.1617

24/7

cigna.com/stateoftn

CVS Caremark

877.522.TNRX (8679)

24/7

info.caremark.com/stateoftn

The Health Insurance Marketplace is a way to purchase health insurance. To assist you as you evaluate options for you and your family, this notice provides some basic information about the Marketplace. The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers "one-stop shopping" to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace is held annually in the fall. Check the www.healthcare.gov website for more information and deadlines.

Health Insurance Marketplace Coverage Notice (PDF)

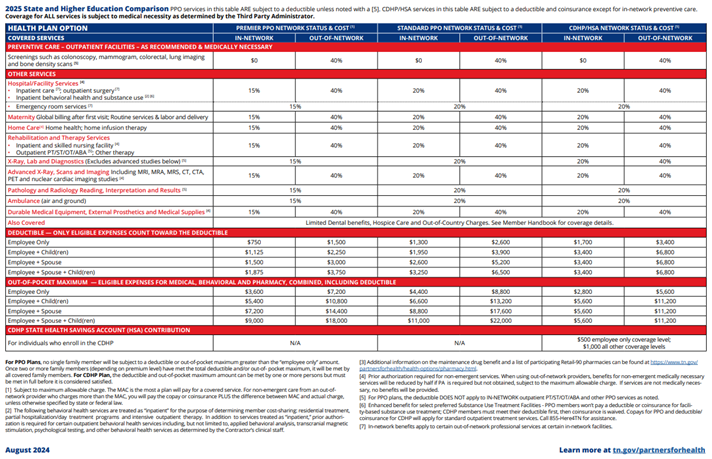

CDHP Consumer-driven health plan, a type of medical insurance or plan that generally has a higher deductible and lower monthly premiums. Typically, you take responsibility for covering your health care expenses until your deductible is met. Once you meet your deductible, coinsurance applies up to the out-of-pocket maximum.

Coinsurance Some services require that you pay coinsurance. Coinsurance is a percentage of the total cost.

Deductible All options include an annual deductible. You pay this amount out of pocket before the plan pays for most services that require coinsurance.

Cost Sharing The share of costs not covered by your insurance that you pay out of your own pocket.

Copay Some services require that you pay a copay. A copay is a flat dollar amount, like $25 for a doctor's visit.

Network A group of doctors, hospitals, facilities and other healthcare providers contracted with a health insurance carrier to provide services to plan members for set fees.

Out-of-Pocket Maximum The out-of-pocket maximum is the most you will pay for your copays, deductible and coinsurance each year. Once you reach your out-of-pocket maximum, the plan pays 100% of covered medical expenses.

In-Network vs. Out-of-Network Providers You can see any doctor or go to any healthcare facility you want. However, if you use an "in-network" provider, you will always pay less. That's because an in-network provider agrees to provide services at discounted rates.

Plan The State of Tennessee Group Insurance Program, including state-sponsored PPO and CDHP/HSA plan options. The plan provides or pays a portion of the cost of medical care and determines how much you pay in premiums, copays and coinsurance.

PPO Preferred provider organization, gives plan participants access to a network of doctors and facilities that charge pre-negotiated (and typically discounted) fees for the services they provide to members. The benefit level covered through the plan depends on whether the member visits an in-network or out-of-network provider when seeking care.